LTCG in debt fund – Time to act

The time to Act is now. Investor has only 4 working days to utilize this benefit.

Dear Investors,

The Finance Bill recently introduced an amendment that will come into effect from 1st April 2023. The amendment proposes that:

“Any income from Mutual Funds in which less than 35% of holding is in Indian Equities (Broadly Debt Mutual Funds), if investment is done after 1st April 2023, will be classified as short term Capital Asset irrespective of Period of Holding.”

As a result, the tax advantage (long term capital gains as opposed to taxation at income slabs) and indexation benefits available to investors in debt schemes of mutual funds will not be available with effect from 1st April 2023.

However, any investments made prior to 1st April 2023 in debt schemes of mutual funds shall continue to be taxed as long-term capital gains on redemption and shall also get the benefit of indexation provided that investment completes three years to fall in purview of long term.

What was the tax advantage in debt schemes of mutual funds?

Interest on investments in fixed deposits are taxable as per the income tax slab of the investor on an annual basis. As such, investors in the high-income bracket normally have to pay tax @30% on the annual interest accrued/realised on their fixed deposits.

In contrast, gains on investments in debt schemes of mutual funds are taxable as long-term capital gains (provided such investments are held for a minimum of 3 years) @ 20% along with the benefit of indexation regardless of the income level of the investor.

The current average interest rate for fixed deposits and the current average estimated growth rate for debt schemes of mutual funds (on a 3-year plus basis) are both approximately 7.50% p.a. Thus, high-income investors get approximately 5.25% p.a. in post-tax returns on investments in fixed deposits, while they get 6.50% p.a. in post-tax returns on investments in debt schemes of mutual funds.

As such, debt schemes of mutual funds were a more attractive investment route for high-income investors to avail the benefit of a lower taxation rate and indexation on such investments.

Does it make sense to invest in debt schemes of mutual funds post 1st April 2023?

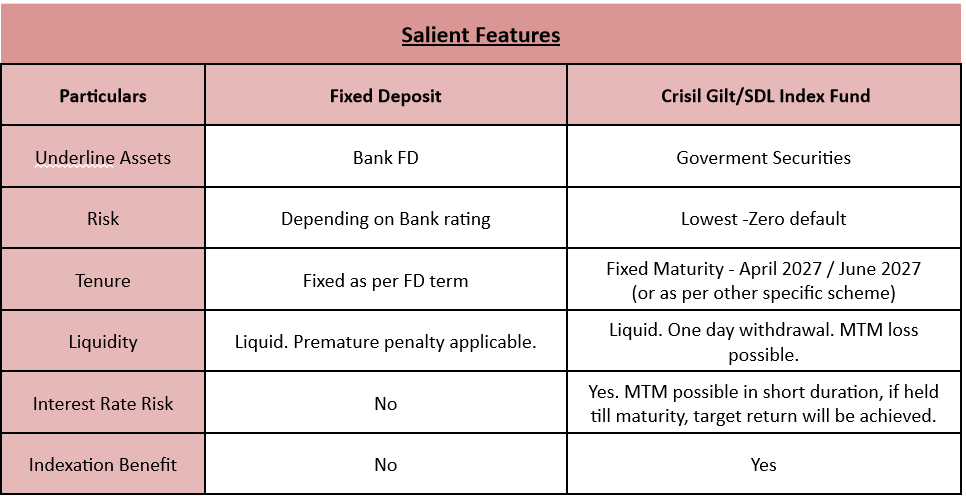

It is true that with the changes to the taxation of debt schemes of mutual funds (withdrawal of long-term capital gains and indexation benefits), investments in fixed deposits appear to be a better bet. However, investors should consider the following advantages retained in investments in debt schemes of mutual funds:

- Tax deferment: Debt mutual funds can act as a tax-deferred investment option as taxes are levied only when the investor redeems the investment.

- Instant liquidity: Debt mutual funds offer instant liquidity at no cost, unlike fixed deposits, which typically have a penalty for premature withdrawal.

- Benefit from falling interest rates: Debt mutual funds offer an opportunity to benefit from capital gains arising out of a falling interest rate scenario.

What should an investor do now?

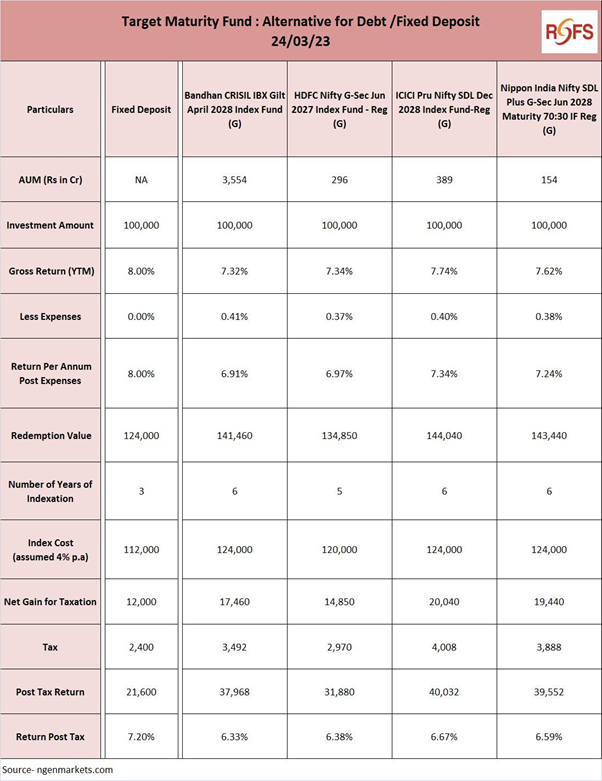

For high-income investors, looking to invest for 5-7 years, and earn post-tax returns of 6.50%+, it is highly recommended that such high-income investors invest into debt schemes of mutual funds having a target maturity in 2027/2028/2029 or later.

Our reasoning for our recommendation above is summarized below:

Table showing Tax advantage in Debt Fund and suggested investment scheme :

NB: These are just 4 schemes enumerated here. There are many other suitable options to invest. Kindly re check with us before investing .

It is recommended that investors consider their risk tolerance and investment goals before making any investment decisions.

We hope this article has provided valuable insights for investors. Please feel free to contact us for any clarifications or further details.

Warm Regards,

Samrendra Tibarewalla, CFPCM

You are the best manager of your money. Please take informed decisions only.

Disclaimer: The author of this article cannot be held responsible for any losses which may be incurred on the basis of above recommendations. Investors are advised to take independent decisions after verifying all facts.

FAQ: Understanding the New Tax Rules for Debt Mutual Funds

Q: What changes were introduced in the Finance Bill regarding mutual funds?

A: The Finance Bill introduced an amendment effective from 1st April 2023, stating that income from Mutual Funds, specifically those with less than 35% holding in Indian Equities (primarily Debt Mutual Funds), will be classified as short-term Capital Assets regardless of the holding period if the investment is made after 1st April 2023.

Q: How were debt schemes of mutual funds taxed before 1st April 2023?

A: Before this amendment, gains from investments in debt schemes of mutual funds were taxed as long-term capital gains at 20% with indexation benefits, provided the investments were held for a minimum of 3 years, irrespective of the investor’s income level.

Q: What was the tax advantage of investing in debt schemes of mutual funds?

A: The key tax advantage was the lower taxation rate (20%) on long-term capital gains, along with the benefit of indexation, which reduced the effective tax rate compared to the taxation of interest from fixed deposits, which could go up to 30% annually for investors in the high-income bracket.

Q: Will investments in debt schemes of mutual funds made before 1st April 2023 still enjoy the previous tax benefits?

A: Yes, investments made in debt schemes of mutual funds before 1st April 2023 will continue to be taxed under the previous rules, enjoying long-term capital gains tax rates and indexation benefits if held for over three years.

Q: Is it beneficial to invest in debt schemes of mutual funds after the new amendment?

A: While the withdrawal of long-term capital gains and indexation benefits for new investments post-1st April 2023 reduces their attractiveness, debt mutual funds still offer advantages like tax deferment, instant liquidity, and the potential for capital gains in a falling interest rate scenario, making them worth considering based on individual financial goals and circumstances.

Q: What are the recommendations for investors considering debt schemes of mutual funds now?

A: For high-income investors with a 5-7 year investment horizon aiming for post-tax returns over 6.50%, it’s recommended to consider debt schemes of mutual funds targeting maturity in 2027/2028/2029 or later, keeping in mind to assess risk tolerance and investment goals.

Q: Are there still suitable investment options in debt mutual funds post the new tax rules?

A: Yes, despite the new tax rules, there remain several suitable debt mutual fund options that can meet investor goals, especially for those with longer investment horizons. It’s important to re-evaluate these options in light of the new taxation framework and consult with financial advisors for personalized advice.