ICICI BAF Revised

Inception Date : 30-Dec-06

Assets under Management (31-Mar-21) : Rs.30,280 Crores

What it does:

ICICI Prudential Balanced Advantage Fund [“BAF”] is a hybrid fund (having a mix of equity & debt) which works on a preset model of investment in the equity market based on Price-to-Book value. Basically buy more equity when market is low & sell when market is high.

Advantages of BAF:

• Tax Efficient (Equity Taxation)

• Auto rebalancing of portfolio

• Blend of large & midcap stocks

Why BAF:

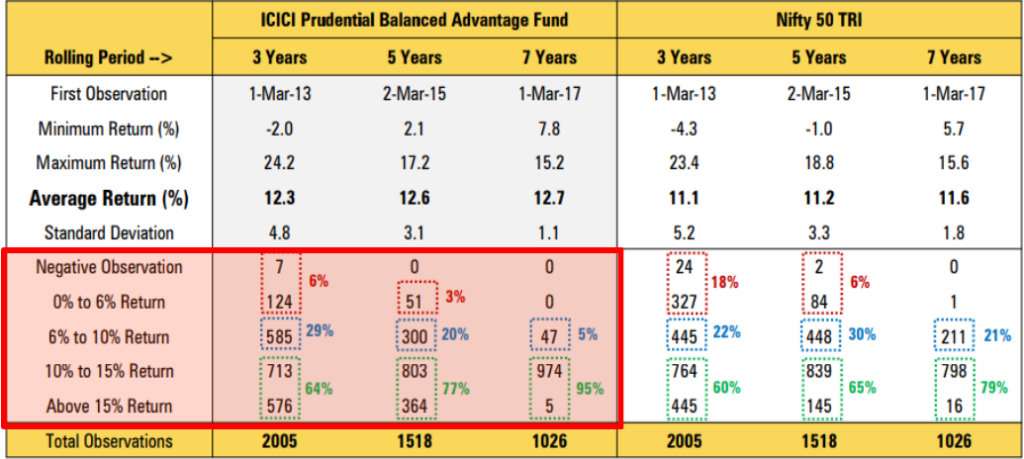

The below chart shows a rolling return for the last 10 years on a 3/5/7 year period:

3 year period – 94% of observations show minimum returns of 6% p.a. CAGR.

5 year period – 97% of observations show minimum returns of 6% p.a. CAGR.

7 year period – 100% of observations show minimum returns of 6% p.a. CAGR.

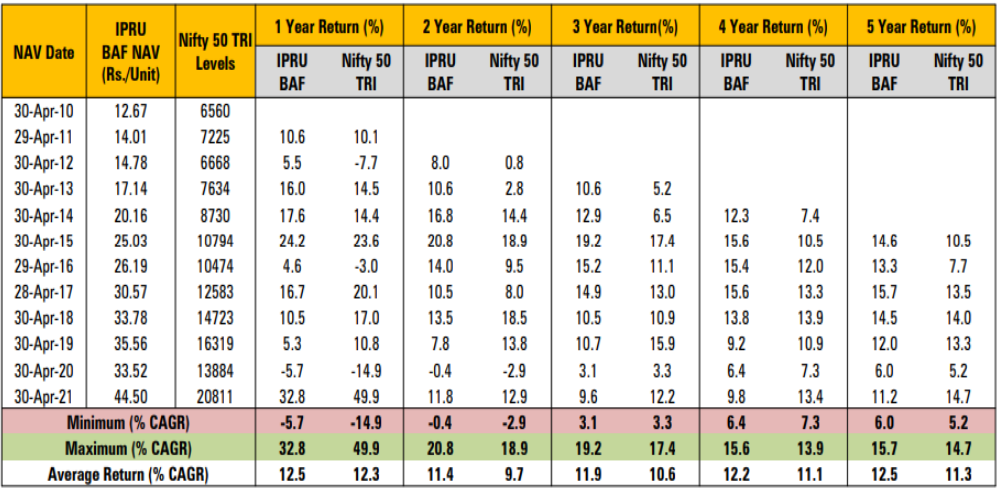

While the minimum return has been 6% p.a. CAGR (for 94% of investments) in the 3 year period, the below chart shows the average rolling return for the same time period to be 11.90%:

Who should invest:

• Investors with a 3 year+ horizon

• Investors who invest in FD and are looking for higher returns

• Investors who are risk averse and do not wish to invest 100% in equity

• Trusts

Please feel free to call for further clarifications.

Thanking you.

Yours Sincerely,

Samrendra Tibarewalla, CFPCM

You are the best manager of your money. Please take informed decisions only.

Disclaimer: The author of this article cannot be held responsible for any losses which may be incurred on the basis of above recommendations. Investors are advised to take independent decisions after verifying all facts.

FAQ: ICICI Prudential Balanced Advantage Fund (BAF) Overview

Q1: What is the ICICI Prudential Balanced Advantage Fund (BAF)?

ICICI Prudential Balanced Advantage Fund is a hybrid mutual fund that invests in a mix of equity and debt assets. It operates on a pre-set investment model that adjusts its equity exposure based on the Price-to-Book value of the market, aiming to buy more equity when the market is low and sell when it is high.

Q2: What are the main advantages of investing in BAF?

The BAF offers several key advantages, including:

- Tax efficiency, thanks to equity taxation

- Automatic rebalancing of the portfolio to maintain an optimal asset allocation

- A diversified investment in both large and mid-cap stocks, aiming for a balanced risk-return profile

Q3: How has BAF performed in terms of returns?

According to rolling return data for the last 10 years, BAF has shown:

- In a 3-year period, 94% of observations showed a minimum return of 6% per annum CAGR.

- Over 5 years, 97% of observations had at least 6% returns per annum CAGR.

- For 7 years, 100% of observations indicated a minimum of 6% returns per annum CAGR. The average rolling return in the 3-year period was 11.90%.

Q4: Who should consider investing in BAF?

BAF is suitable for:

- Investors looking for a medium to long-term investment horizon of 3 years or more.

- Those who are currently investing in fixed deposits and desire higher returns.

- Risk-averse investors who prefer not to allocate 100% of their investment to equities.

- Trusts seeking a balanced investment approach.

Q5: Why is BAF considered tax-efficient?

BAF is tax-efficient because it qualifies for equity taxation, meaning that its tax treatment is more favorable compared to purely debt-oriented investments. This can enhance the after-tax returns for investors, making it an attractive option for those looking to optimize their tax liabilities.

Q6: What does the automatic rebalancing of the portfolio mean?

Automatic rebalancing refers to the fund’s strategy of periodically adjusting its asset allocation between equity and debt to maintain the fund’s target balance. This process helps manage risk and capitalize on market opportunities without requiring manual intervention by the investor.