Happy New year

“Crisis Breeds Opportunity”

Dear Friends,

The world seems to have turned topsy-turvy in the past two months with lockdowns, the ‘Black Swan’ event of Franklin Templeton’s closure of its debt funds, NIFTY dropping by almost 35% in the month of March alone, and the government announcing an economic stimulus of 10% of our GDP, etc. It is safe to say that the average investor does not know which way is up and which way is down anymore.

On April 23, 2020, Franklin Templeton (“FT”) announced the winding up of 6 of their debt funds, with suspension effective immediately, due to COVID-19. This is what we refer to as a ‘Black Swan’ event, due to the unexpected and rare nature of the occurrence.

FT has now been in India for over 25 years and was managing close to 1.25 lakh crores. It belongs to the Franklin group, which is a global giant, consistently ranking in the top 5 financial groups in the world. Thus, we pay a premium for their reputation and for a ‘security’ factor being the trust upon their ability to manage any kind of situation and never default.

However, the management of FT took a drastic step to prevent further capital erosion and closed their debt funds, resulting in a delay in the return of capital to investors. In my humble opinion as a financial advisor with 19 years of experience, this act represents a breach of trust and is unacceptable. As such, I will be exiting the FT group, lock, stock and barrel.

More recently, the Government of India has announced huge economic stimuli in an effort to revive the economy by giving reliefs and advances to the tune of almost Rs 20 lakh crores! This figure constitutes approximately 10% of our annual GDP. They have been mindful of all sectors focusing on agriculture, daily wage earners, to MSME and traders.

However, only time can be the true test of these incentives. If the lockdown continues, no amount of incentives would be able to save the economy. It is pertinent that the economy opens up and normalcy returns with all guidelines in place.

What should an investor in MF Debt Markets do?

A lot of companies’ finances will be affected due to the 2-month lockdown. Despite the massive economic stimulus, I believe that many organizations will shut shop for good. There will be delays/defaults in repayments, prompting re-ratings of the companies and thereby affecting MTM and causing notional losses. The riskiest asset class is credit risk funds, and the safest is gilt funds.

RSFS Advice:

Exit all credit risk funds or so and deploy capital in two avenues, for the next six months:

- Pure liquid/gilt funds ( though gilt funds have duration risk) or

- Bank’s current account/ FD’s

We would recommend you to primarily choose option 2.

What should an investor in MF Equity Markets do?

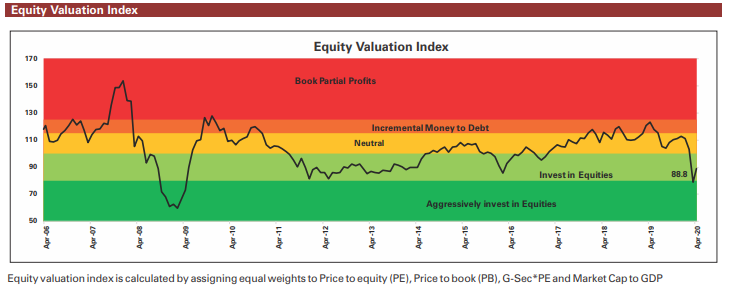

Currently the Nifty is fairly valued at 9100 level, with a trailing PE of 20 and Price to Book ratio of 2.5 approx.

I see no immediate upside in either the world economy or India’s economy until a cure for COVID-19 is discovered. Therefore, in all probability the markets will continue to slide downwards before stabilizing.

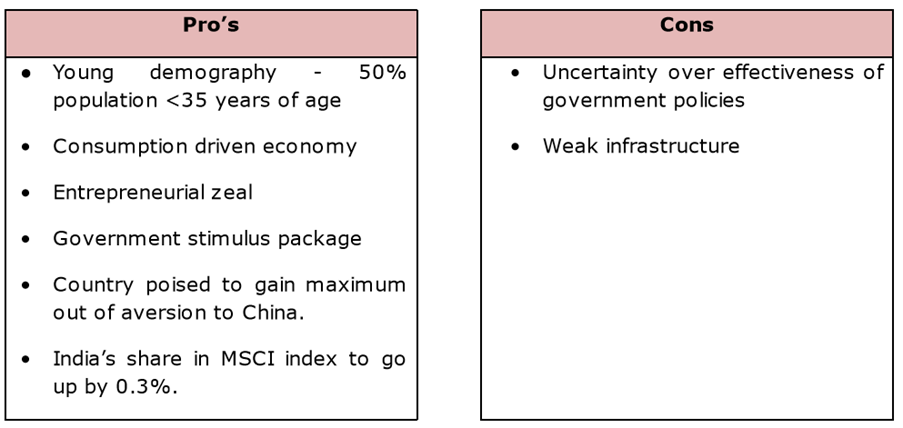

I am of the view that the year 2020 will be a very favorable year for investors. I believe that we belong to the winning team, as India is bound to recover quickly post COVID-19. The reasons being:

RSFS Advice:

- New investors with a long term horizon should invest in SIP/STP mode primarily in Multicap/Large & Midcap Equity funds.

- Existing investors should look to increase their current SIP investments.

- Investors wanting to invest into equities in one go should sit on cash, and wait for better opportunities that might accrue in the near term.

PS: We advise you to conserve cash and only invest surplus amounts which you are comfortable investing. CASH IS KING.

To conclude, it is paramount that we keep our focus on our long term goals and not be deterred by the short term volatilities. Remember, downs are temporary, and ups are permanent. The Indian stock market, in spite of everything, has gone from 100 in 1979 to 31000 in 2020.

As the famous Chinese general Sun Tzu very aptly said, “in the midst of chaos, there is also opportunity”. Have faith, have trust. This, too, shall pass.

Warm regards,

Samrendra Tibarewalla, CFPCM

PS: You are the best manager of your money. Please take informed decisions only.

Disclaimer: The author of this article cannot be held responsible for any losses which may be incurred on the basis of above recommendations. Investors are advised to take independent decisions after verifying all facts.

FAQ: Financial Strategies for the New Year Amid Market Uncertainty

Q1: What led to the current market volatility?

Recent market volatility has been spurred by several unprecedented events, including widespread lockdowns, the unexpected closure of Franklin Templeton’s debt funds, a significant drop in the NIFTY index, and the Indian government’s announcement of an economic stimulus package amounting to 10% of the GDP.

Q2: What was the ‘Black Swan’ event involving Franklin Templeton?

On April 23, 2020, Franklin Templeton announced the winding up of six of their debt funds due to the market impact of COVID-19. This unexpected and rare event, termed a ‘Black Swan,’ led to a suspension of these funds, delaying the return of capital to investors, and has been seen as a breach of trust by some in the financial community.

Q3: How has the Indian government responded to the economic impact of COVID-19?

The Government of India announced a massive economic stimulus package, nearly Rs 20 lakh crores, approximately 10% of the country’s annual GDP. This package aims to support various sectors, including agriculture, daily wage earners, MSMEs, and traders, in an effort to revive the economy.

Q4: What advice is given for investors in MF Debt Markets?

Given the financial strain on companies due to lockdowns and potential delays or defaults in repayments, it’s advised to exit all credit risk funds. Investors should consider reallocating their capital to safer avenues like pure liquid/gilt funds or bank current accounts/FDs, with a preference for the latter.

Q5: What should investors in MF Equity Markets do?

For new investors with a long-term horizon, investing in SIP/STP mode in Multicap/Large & Midcap Equity funds is recommended. Existing investors might consider increasing their SIP investments. Those looking to invest a lump sum in equities should conserve cash and wait for more favorable market conditions.

Q6: How should investors approach their financial strategy during this period?

The key message is to focus on long-term financial goals and not be swayed by short-term market volatilities. Conserving cash and investing only surplus amounts comfortably is crucial. The belief is that despite current challenges, the Indian market is poised for recovery, emphasizing that “in the midst of chaos, there is also opportunity.”