RBI Bites the Bullet

Dear Friends,

I am reproducing extracts of an article dated 3rd Aug which appeared in Economic times, with some portions highlighted (full article appended below). This article highlights how fund managers are advising their clients to exit long term debt funds and shift investments to short term funds.

My take is, we have to preempt, rather than taking action, when the horse has bolted from the stable.

To validate what I mean, I am also reproducing portions of my articles on the subject in last few months.(full articles can be read under blog section at www. riddhi-siddhi.org)

ET – 3rd Aug’2018

Blog Dated 10th Aug’2016

As such, it would be wise and prudent for investors to switch from Duration funds to Accrual funds in debt. This move would ensure that investor gets 8% + return on a very conservative side on an annualized basis.

Blog Dated 15th Feb 2017

For investing in debt funds, the safest bet would be Short Term Accrual Funds

ET – 3rd Aug’2018

ET – 3rd Aug’2018

Blog Dated 30th Dec 2017

As such, I would advise to continue to be invested in Accrual Products and any new investment that needs to be done should be done in Short term Accrual Product with 12 to 24 month maturity papers only.

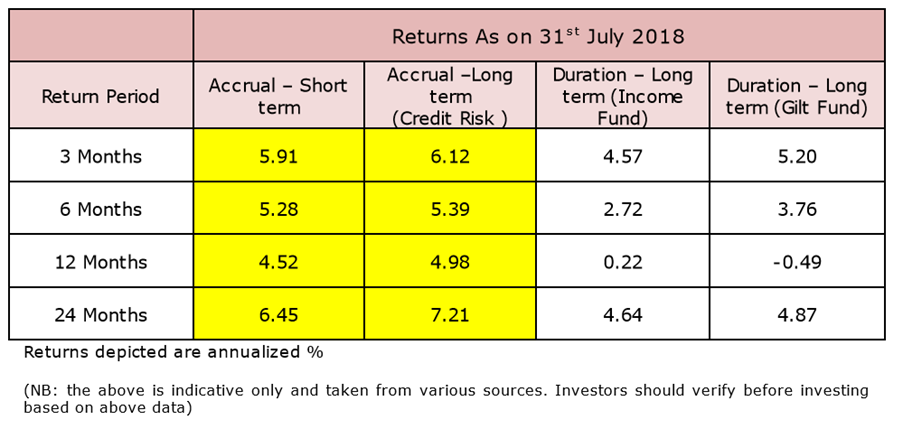

A brief return summary of Accrual and Duration funds is given below:

In the last two months, RBI has raised repo rates twice by 25 basis points each. The current bond yields are hovering around 7.9%, which indicates that bond markets are expecting another 25 bps hike in times to come. My sense or belief is that the economy can, at the most, take a 25/50 bps hike in interest rates in the next 12 months. Anything more than this should result in dampening the economic growth and, subsequently, the stock markets.

As such, in debt funds, investors should invest in Short term Accrual schemes only with 12 months maturity paper max.

With warm regards,

Samrendra Tibarewalla, CFPCM

PS: You are the best manager of your money. Please take informed decisions only.

Disclaimer: The author in no way will be held responsible for losses incurred on the basis of above recommendations. The investors are advised to take independent decisions after verifying all facts

FAQ : “RBI Bites the Bullet”

Q1: What recent advice have fund managers given regarding long-term debt funds?

A1: Fund managers are advising their clients to exit long-term debt funds and shift their investments to short-term funds, as highlighted in an article from Economic Times dated August 3, 2018.

Q2: What is the author’s stance on reacting to financial market changes?

A2: The author believes in preempting market changes rather than reacting after they occur, suggesting that actions should be taken before it’s too late, metaphorically before “the horse has bolted from the stable.”

Q3: What are Short Term Accrual Funds and why are they recommended?

A3: Short Term Accrual Funds, as advised on February 15, 2017, are considered the safest bet for investing in debt funds. These funds focus on papers with 12 to 24 months maturity, aiming for stable returns in the short term.

Q4: How have recent RBI rate hikes affected the bond market?

A4: In the last two months prior to the article’s publication, the RBI raised repo rates twice by 25 basis points each, leading to current bond yields hovering around 7.9%. This indicates market expectations of another 25 basis points hike in the near future.

Q5: Why are Accrual Funds preferred over Duration Funds in the current market?

A5: Accrual Funds are preferred due to their focus on earning interest income over a specified period, usually offering a conservative but stable return. In contrast, Duration Funds are more sensitive to interest rate changes, making them riskier in a volatile market environment.

Q6: How do recent RBI repo rate hikes impact individual investors?

A6: Recent RBI repo rate hikes can affect individual investors by making loans more expensive and altering the investment attractiveness of various financial instruments. For debt fund investors, these hikes can lead to lower prices for existing bonds, affecting fund NAV negatively.