Note on SEBI Rule on Multicap funds

September 13, 2020

Dear Investor,

Synopsis of Change Effected in Multi Cap Funds – Refer SEBI Circular dated Sept. 11, 2020

When: September 11, 2020

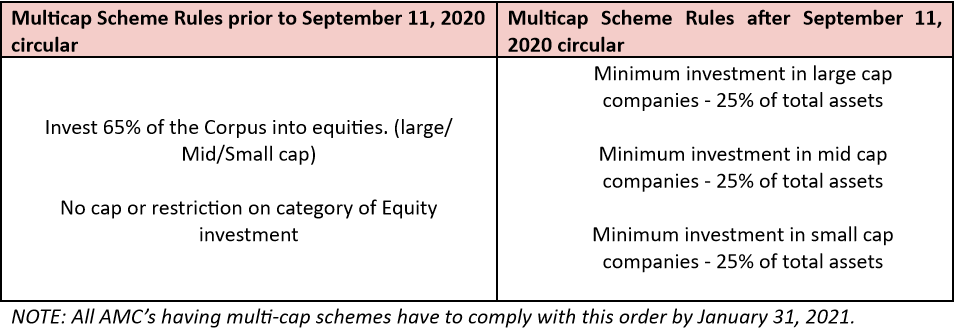

What: SEBI vide its Circular no. SEBI/HO/IMD/DF3/CIR/P/2020/172, has issued guidelines regarding the categorization and rationalization of Mutual Fund Schemes. In order to diversify the underlying investments of Multi Cap Funds across the large, mid, and small cap companies and be true to label, it has been decided to partially modify the characteristics of Multi Cap schemes as follows:

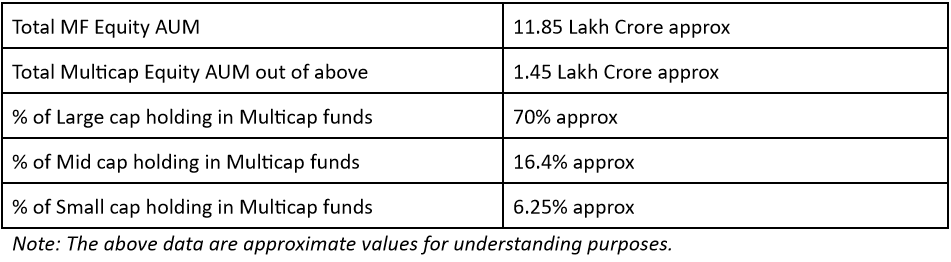

HOW BIG IS THE MULTI-CAP INDUSTRY AND WHAT ARE THE SPECIFICS OF THE MULTI-CAP SCHEMES:

Thus, a natural fall-out from the SEBI circular is that these multi-cap funds will need to sell their large-cap stocks and purchase mid and small cap funds to the tune of approx. Rs. 40,000 Cr. While it may look like a big opportunity and buying frenzy in mid and small cap funds, it might not be so. Let us explore alternative options below:

What Options do AMC’s have?

Option 1: Rebalance the portfolio allocation in schemes by January 31, 2021. The industry will have to sell large cap stocks and have to buy mid and small cap stocks to the tune of approx. Rs. 40,000 Cr. This looks very daunting keeping in mind the liquidity factor and valuation of mid and small cap stocks.

Option 2: Convert multi-cap schemes to other categories, viz. large and mid-cap category. AMC’s might convert existing multi-cap schemes having exposure to large and midcap stocks in their mutlicap funds to large and mid-cap category or any other category.

Option 3: Merge existing multi-cap schemes with other schemes, viz. large cap schemes For example, a multi-cap scheme having a large exposure in large cap stocks may decide to merge with their existing large cap scheme.

What should an existing investor do if he has investments in multi-cap schemes?

Existing investors in such multicap schemes MUST WAIT FOR MORE CLARITY and NOT ACT IN HASTE.

- MF industry will represent to SEBI for more time and clarification or relaxation

- MF industry might ask for introduction of another category viz Flexi cap.

- Each individual AMC will decide on one of the 3 options that they have in front of them once they receive clarification from SEBI

- Once we receive clarifications on the course of action taken by each AMC, we shall decide on our course of action for our investments keeping in mind our goals and asset allocation.

We shall keep you posted regularly on all the developments.

Warm Regards,

Samrendra Tibarewalla, CFPCM

You are the best manager of your money. Please take informed decisions only.

Disclaimer: The author of this article cannot be held responsible for any losses which may be incurred on the basis of above recommendations. Investors are advised to take independent decisions after verifying all facts.

FAQ: SEBI’s New Rule on Multicap Funds

Q1: What changes has SEBI made to multicap funds?

On September 11, 2020, SEBI issued a circular modifying the investment strategy of multicap mutual funds. The new guidelines mandate these funds to diversify their investments more evenly across large, mid, and small-cap companies to ensure the scheme’s portfolio is true to its multicap label.

Q2: Why did SEBI introduce these changes to multicap funds?

SEBI’s decision to modify multicap fund guidelines aims to ensure that these funds truly reflect the multicap strategy by diversifying their investments across companies of different market capitalizations. This move is intended to protect investors by providing a more balanced investment approach.

Q3: What options do Asset Management Companies (AMCs) have following this SEBI circular?

AMCs have three options following the SEBI circular:

- Rebalance the portfolio by January 31, 2021, to meet the new requirements, which involves selling large-cap stocks and buying mid and small-cap stocks.

- Convert multicap schemes to other categories such as large and mid-cap to align more closely with the fund’s existing investments.

- Merge multicap schemes with other schemes, such as large-cap schemes, if they have a significant large-cap exposure.

Q4: How significant is the impact of these changes on the multicap fund industry?

The SEBI circular necessitates a rebalancing of portfolios with an estimated movement of Rs. 40,000 Cr from large-cap to mid and small-cap stocks. While this presents a potential opportunity for mid and small-cap segments, challenges related to liquidity and valuation may temper the immediate impact.

Q5: What should investors in multicap funds do in response to these changes?

Investors are advised to wait for further clarity and not make hasty decisions. The mutual fund industry is likely to seek additional time and clarification or even a relaxation of these rules from SEBI. Once more information is available, and AMCs announce their chosen course of action, investors can then make informed decisions based on their investment goals and asset allocation.