Debt Funds Outlook

Dear Friends,

The year 2017 comes to a close. What a year it has been !!

Sensex & Nifty have gained by around 30% each, while the INR has appreciated by over 6%. Gold has gained by 7%. In contrast, the benchmark 10-year government bond is the worst-performing asset in calendar year 2017. The bond yield has risen by 100 bps over the year and has given negative returns.

In my article dated 30th Aug’2016 and 10th April 2017, and throughout 2017, we had advised investors to move out from gilt/duration funds and invest in accrual products as the yields had come down to abysmal lows of 6.30 % in early 2017 without commensurate reduction in rates by RBI.

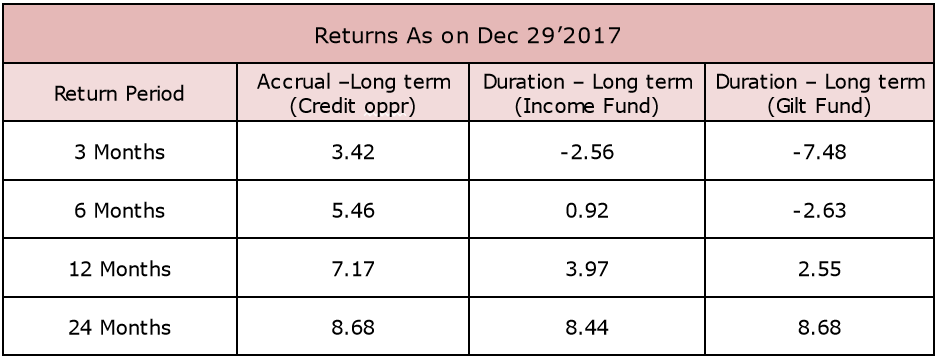

A brief return summary of Accrual and Duration funds is given below:

Returns depicted are annualized %

(NB: the above is indicative only and taken from various sources. Investors should verify before investing based on above data)

Last 3 months saw bond prices crashing and yields moving to as high as 7.37 % (6.79 % 10-year 2027 Bond). The surge in yield resulted in wiping almost entire year gain for Debt funds. Such high yield is also an aberration, the way it was in early 2017 when yields had hit lows of 6.30%.

India’s macro fundamentals do not warrant a too sharp rise in yields.

- Forex reserves are at record highs

- CAD is still below 2% of GDP

The country can ill afford any increase in interest rates, and as I see it, next 6 -12 months, there should be stable interest rate regime unless there is some international event viz spike in oil price, geo-political issues etc.

As such, I would advise to continue to be invested in Accrual Products, and any new investment that needs to be done should be done in Short term Accrual Product with 12 to 24 month maturity papers only.

Wishing all a very Happy and Prosperous 2018 !!!

With warm regards,

Samrendra Tibarewalla, CFPCM

PS: You are the best manager of your money. Please take informed decisions only.

Disclaimer : The author in no way will be held responsible for losses incurred on the basis of above recommendations. The investors are advised to take independent decisions after verifying all facts.

FAQ : “Debt Funds Outlook”

Q1: How did the Sensex, Nifty, INR, and gold perform in 2017?

A1: In 2017, both the Sensex and Nifty experienced gains of around 30% each. The Indian Rupee (INR) appreciated by over 6%, and gold saw a 7% increase in value.

Q2: How did benchmark 10-year government bonds perform in 2017?

A2: The benchmark 10-year government bond was the worst-performing asset in 2017, with the bond yield rising by 100 basis points over the year, resulting in negative returns.

Q3: What investment advice was given throughout 2017 regarding debt funds?

A3: Throughout 2017, the advice was to move out from gilt/duration funds and invest in accrual products. This advice was based on the yields dropping to lows of 6.30% in early 2017 without a corresponding reduction in rates by the RBI.

Q4: What happened to bond prices and yields in the last three months of 2017?

A4: In the last three months of 2017, bond prices crashed, and yields rose to as high as 7.37% for the 10-year 2027 Bond. This surge in yield nearly wiped out the entire year’s gain for debt funds.

Q5: Do India’s macro fundamentals support a sharp rise in yields?

A5: According to the article, India’s macro fundamentals, including record-high forex reserves and a Current Account Deficit (CAD) below 2% of GDP, do not warrant a too sharp rise in yields.