Crisil GiltSDL target maturity fund

Opportunity to earn High Tax free Return in Fixed Maturity Gilt/SDL Target Maturity Fund

This is almost a repeat of what I had suggested in my note dated 7th June 2022

Dear Investor, 14th Oct 2022

- Are you investing in Fixed Deposits?

- Do you invest in Fixed Deposits for more than three years of maturity?

If yes, we present you with a better investment option:

RBI has recently raised the Repo rate by 50 bps taking it to 5.90%. It is widely believed that RBI, in the next 6- 12 months’ time, will raise the interest rate by another 50 bps, thereby taking the repo rate in the region of 6-6.50%. We believe that Repo rates should settle in this region only.

The current 10-year Gsec yield is approximately 7.50%, and we believe the given macroeconomic scenario, it would top out at an 8.00% yield. For the last 18 to 24 months, we were not in favor of investing in long-term debt funds (refer to a note dated 16th May 2020). We now believe that, in the next 6 months, time would be conducive to investing in debt funds once again.

-note dated 7th June 2022.

Since June 2022, RBI has hiked the Repo rate aggressively by another 150 bps taking it to 5.90% currently. The 10-year G Sec yield as of today is still 7.40 to 7.50% approx. The markets had factored in all increases prior to June 2022. We strongly believe that at max 10-year G sec yield can touch 8%.

The current market situation gives a very good opportunity for an investor to earn a handsome post-tax return without taking any risk. We believe that the following investment is best suited for:

- IDEALLY SUITED FOR: Individual/companies investing in Fixed Deposit

- DURATION: 4 years to 5 Years

- EXPECTED RETURN: Post Tax 6%+

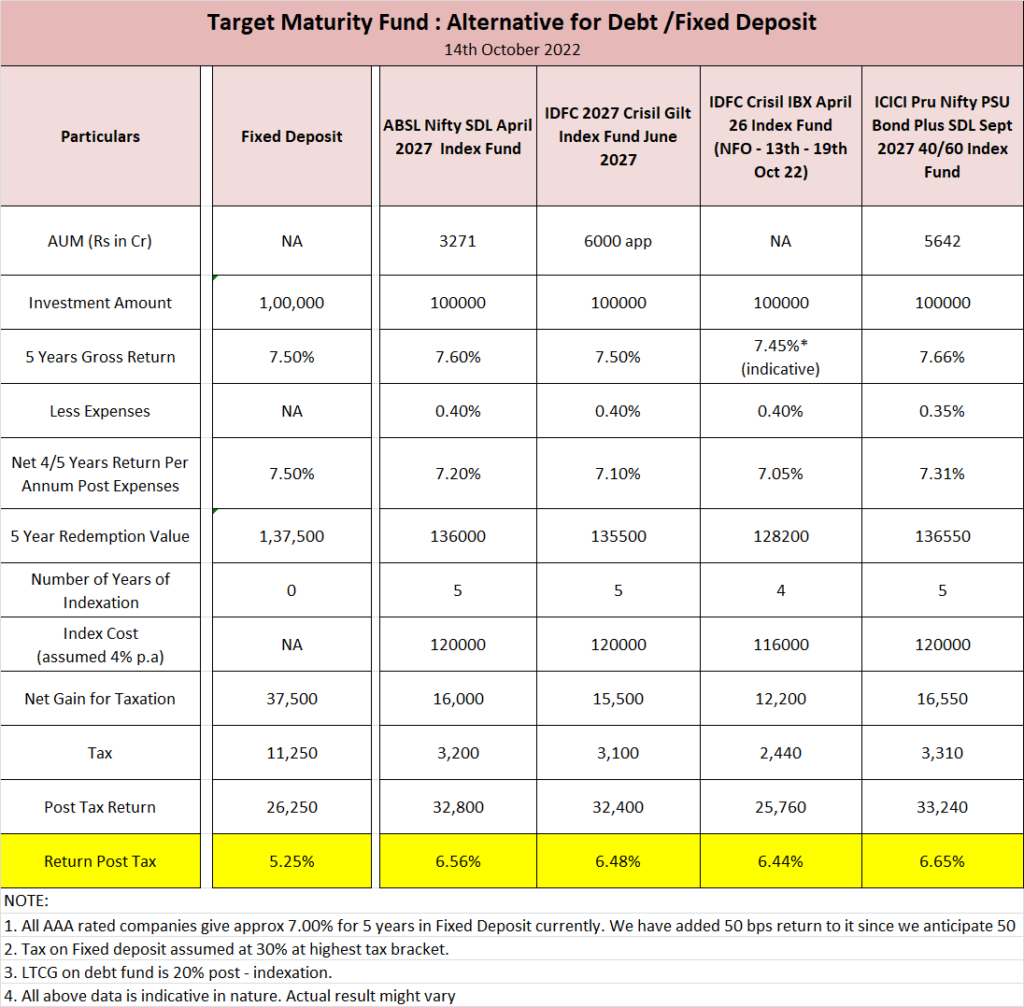

A brief illustration is attached herewith:

We believe that the current bond market situation gives a very good opportunity for long term debt or Fixed Deposit investors to invest funds for 4 or 5 years and earn risk free return of 6% + per annum.

Please call for any further clarification.

Warm Regards,

Samrendra Tibarewalla, CFPCM

You are the best manager of your money. Please take informed decisions only.

Disclaimer: The author of this article cannot be held responsible for any losses which may be incurred on the basis of above recommendations. Investors are advised to take independent decisions after verifying all facts.

FAQ: Crisil GiltSDL Target Maturity Fund

Q1: What is a Crisil GiltSDL Target Maturity Fund?

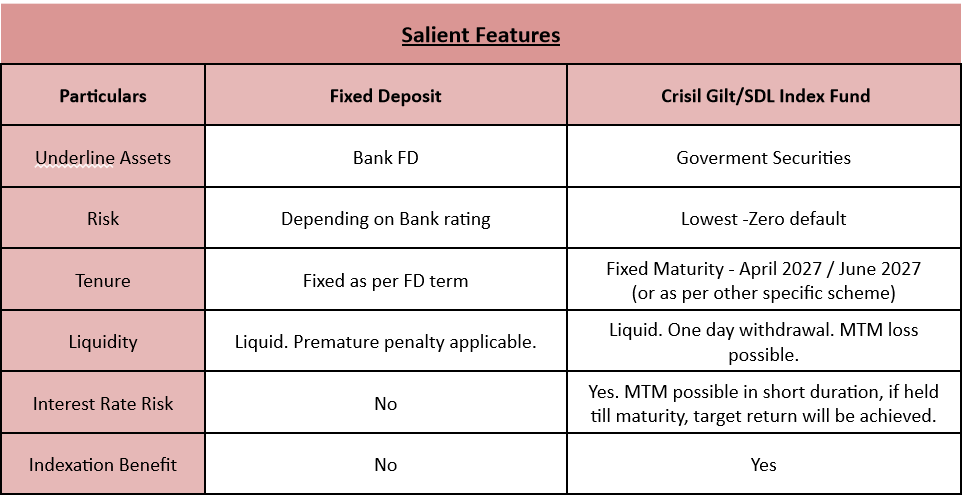

A Crisil GiltSDL Target Maturity Fund is a type of fixed maturity investment that focuses on government securities (G-Secs) and State Development Loans (SDLs). It offers investors an opportunity to earn high, tax-free returns over a fixed period. This investment is particularly appealing during times when the Reserve Bank of India (RBI) adjusts the repo rate, influencing the yield on government securities.

Q2: Why consider Crisil GiltSDL Target Maturity Fund over Fixed Deposits?

With the recent hike in the repo rate by the RBI, the yield on 10-year government securities has become more attractive, currently standing at approximately 7.40 to 7.50%. Considering the tax advantages and expected returns, investing in a Crisil GiltSDL Target Maturity Fund could offer better post-tax returns than traditional fixed deposits, especially for investments with a maturity of more than three years.

Q3: What are the expected returns from Crisil GiltSDL Target Maturity Fund?

The fund targets to offer a post-tax return of over 6% per annum. This projection is based on the current and expected macroeconomic scenario where the 10-year government security yield may top out at around 8.00%. These returns are considered risk-free, assuming the investor holds onto the fund until its maturity.

Q4: Who should invest in Crisil GiltSDL Target Maturity Fund?

This fund is ideally suited for individuals or companies that traditionally invest in fixed deposits and are looking for higher, tax-efficient returns. It is most beneficial for investments with a duration of 4 to 5 years, offering a solid alternative for long-term debt or fixed deposit investors seeking risk-free annual returns exceeding 6%.

Q5: How does the recent RBI rate hike affect Crisil GiltSDL Target Maturity Fund investments?

The RBI’s recent decision to increase the repo rate by 50 basis points to 5.90%, with expectations of a further increase, creates a favorable environment for investing in debt funds like the Crisil GiltSDL Target Maturity Fund. As the yield on 10-year G-Secs is expected to stabilize around 7.50% to 8.00%, now is considered an opportune time to invest in such funds, with the potential for higher yields in the near future.