Alternative to FMP/FD/Tax Free bonds

Dear Friends,

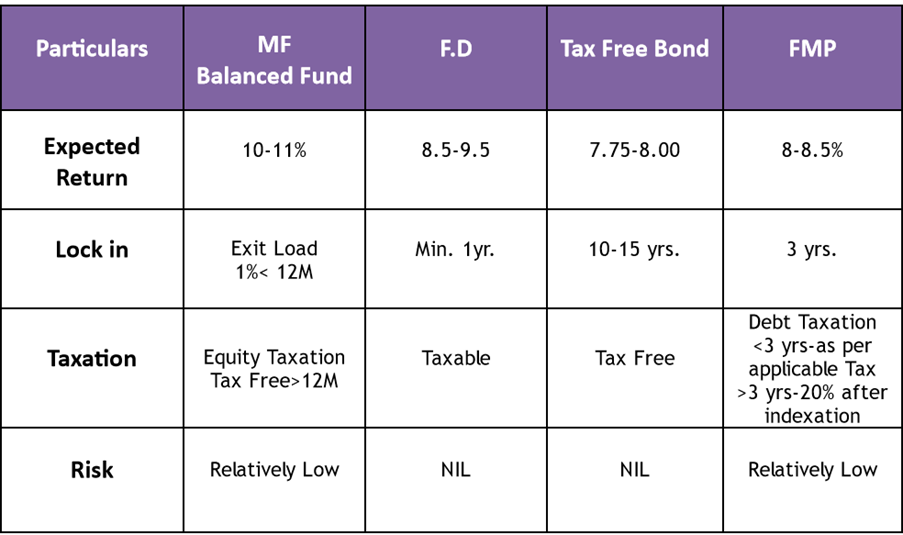

In Feb’2014, GOI came out with Tax-free bonds bearing an Interest rate of up to 8.90% for 15 yrs bond. With the decrease of 50 Bps in interest in FY 2015 and further downtrend, it is expected that this year Tax-free bonds would be issued in the range of 7.75 to 8.00% interest.

FMP’s and FD’s too, give returns of now in the range of 8.00 to 9.50% pa.

For all the investors investing in the above instruments, there is an alternate investment option available through a Mutual Fund in the form of a “BALANCED FUND”.

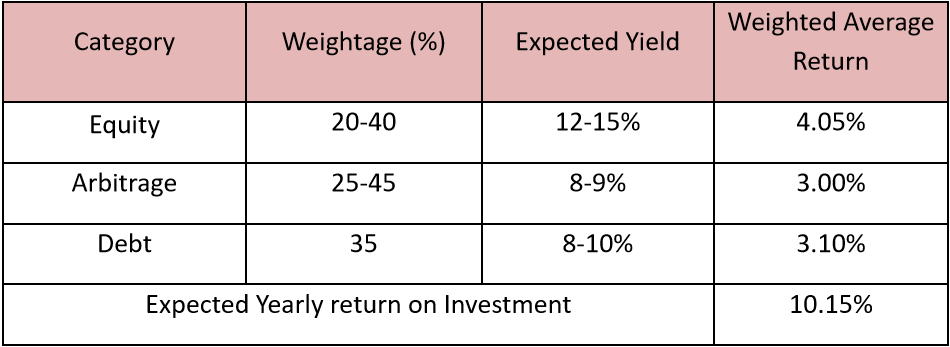

Balanced Funds, as the name suggests, have a mix of Equity and Debt. While several various combinations of Balanced funds are available, in my view, a typical balanced fund composition would be as follows:

An illustration of return in Balanced Fund:

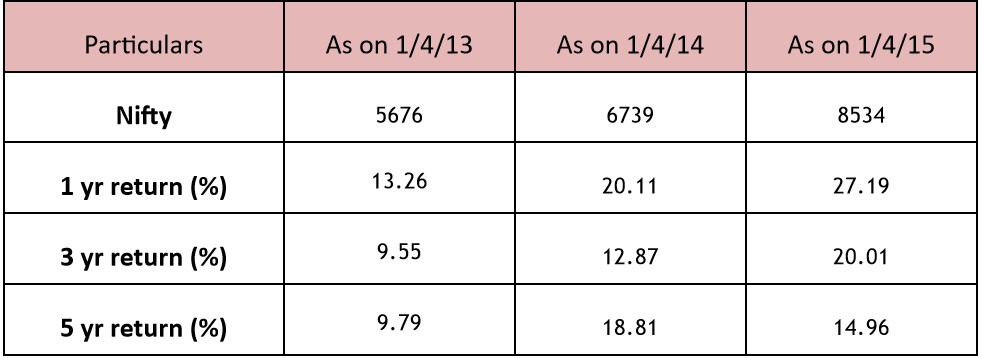

The return of ICICI Prudential Balanced Advantage Fund is as below.

[Note: Returns are high as equity exposure in ICICI Prudential Balanced Advantage Fund is higher from 45-65]

The above illustration clearly establishes the advantages of BALANCED FUND over other investment avenues.

The suggested fund mix should have a variance of +/- 3%, i.e. return can vary from 7% to 13% in a short -run but over a little longer duration of say >2 years we should have a tax free average return of 10% + .

To conclude, in my opinion,“Balanced schemes” of Mutual Fund presents an excellent opportunity to earn tax free return in excess of 10% with relatively very negligible risk.

With warm regards,

Samrendra Tibarewalla, CFPCM

PS: You are the best manager of your money. Please take informed decisions only.

Disclaimer : The author in no way will be held responsible for losses incurred on the basis of above re commendations. The investors are advised to take independent decisions after verifying all facts.

FAQ: Investing in Balanced Funds as an Alternative

1. What are the interest rates for Tax-free bonds issued by the Government of India in February 2014?

In February 2014, the Government of India issued Tax-free bonds with interest rates up to 8.90% for a 15-year bond. Due to a subsequent decrease of 50 basis points in interest rates in FY 2015 and a further downtrend, it is expected that Tax-free bonds issued this year would have interest rates in the range of 7.75 to 8.00%.

2. How do the returns on Fixed Maturity Plans (FMPs) and Fixed Deposits (FDs) currently compare?

FMPs and FDs are now offering returns in the range of 8.00 to 9.50% per annum, presenting competitive interest rates for investors looking for fixed income investments.

3. What is a Balanced Fund, and how does it serve as an alternative investment option?

A Balanced Fund is a type of Mutual Fund that combines Equity and Debt investments in its portfolio. It aims to provide a balance between risk and return, making it a suitable alternative investment option for those investing in FMPs, FDs, and Tax-free bonds.

4. Why are Balanced Funds recommended as an excellent opportunity for investors?

Balanced Funds are recommended because they present an excellent opportunity to earn tax-free returns in excess of 10% with relatively negligible risk, especially when compared to other fixed-income investment options like FMPs, FDs, and Tax-free bonds.