Dear Friends,

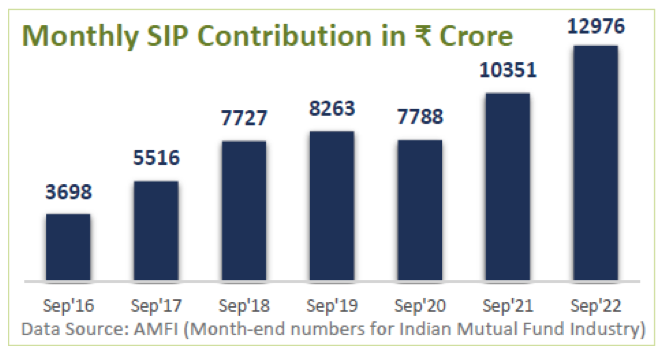

Investment in Equity Mutual Funds in SIP mode is one of the best ways to create long term wealth. The graph on the right shows the investor’s confidence over the years in this product.

We try and address few of the frequently asked questions.

Q1. Is SIP in Equity Mutual Funds Risky?

“Permanent loss in a Broadly Diversified Equity Scheme is only possible by the investor and not the market.”

– Nick Murray

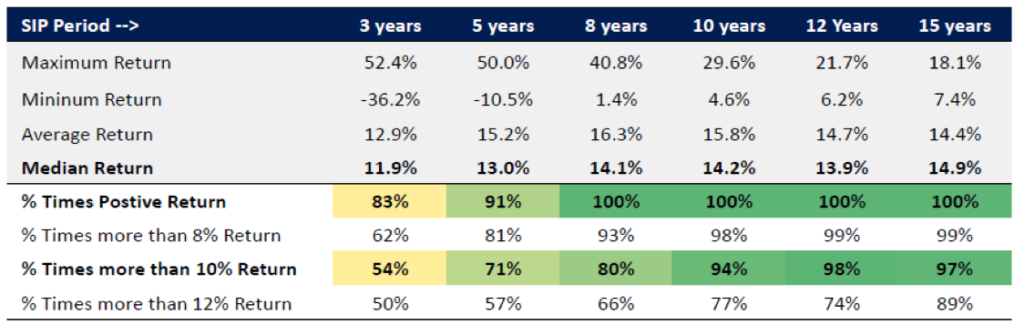

In our opinion for long term investing, Equity markets are least risky asset class. If an investor is doing SIP over 10 years, 100% of the time he has made positive return, average yield being 13-14% p.a.

Note: For illustration purpose only. Above returns are %XIRR Rolling Returns on monthly basis for S&P BSE Sensex TRI for SIP between Sep 1996 to Sep 2022. Past performance may or may not be sustained in future. Source: WHITEOAK Capital Mutual Fund

Q2. Which category of Equity scheme should I invest into – Large cap, Mid cap or Small cap?

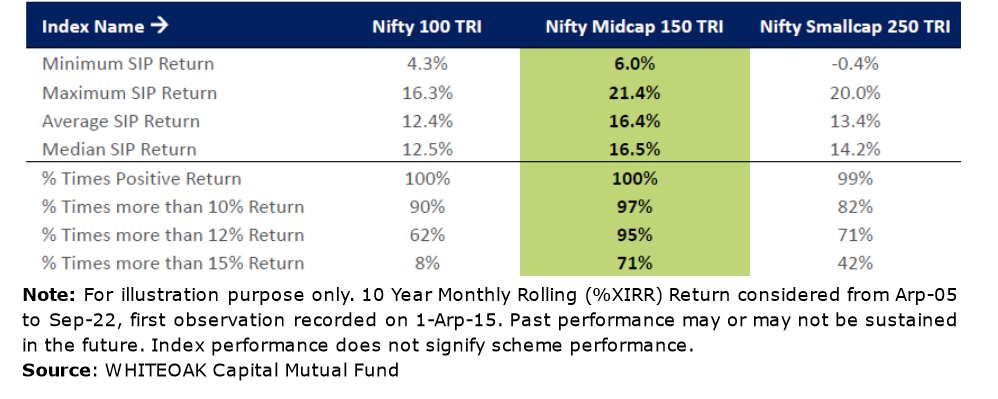

Investors normally flock to Large caps in Equity schemes since they are generally less volatile. However, study suggests that in long term Mid cap segment gives best returns.

Mid Cap segment can be a good investment option for the investors seeking to invest via the long- term SIP route.

Q3. Which date to select for monthly SIP?

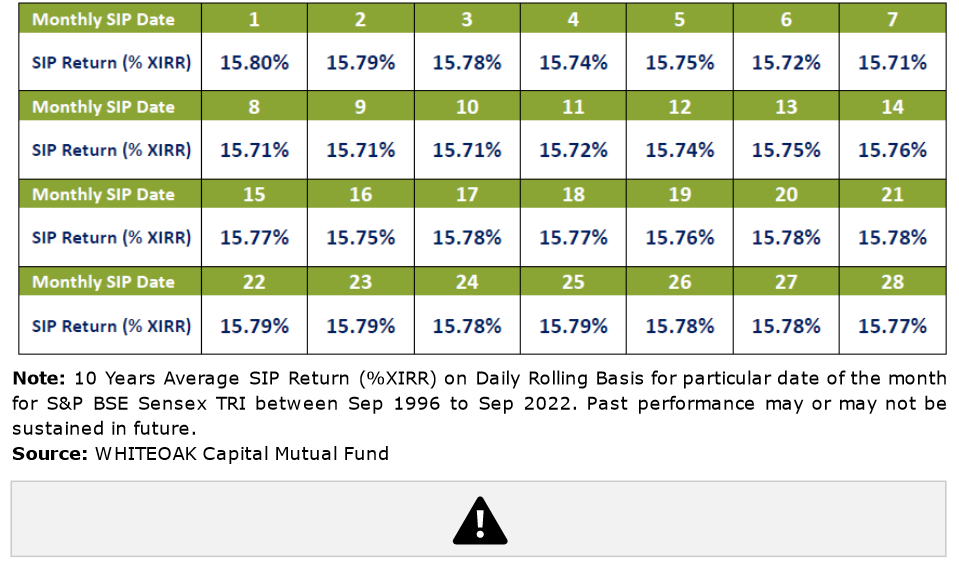

Last 26 years data suggest that there is no meaningful difference between average returns of different dates of 10 years SIP.

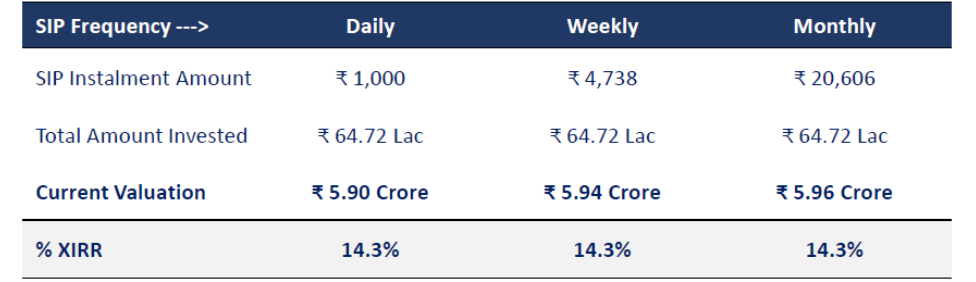

Q4. Which SIP frequency to select?

Many a times, investors get carried away thinking that daily SIP is best as rupee cost averaging is done daily. Not only is it an accounting nightmare, data also suggest that there is no meaningful additional return generated

Note: %XIRR for S&P BSE Sensex TRI for SIP between Sep 1996 to Sep 2022. SIP installment amounts are selected in such a way, so that the total investment remains the same in all three frequencies for better comparison. Past performance may or may not be sustained in future. Source: WHITEOAK Capital Mutual Fund

Warm regards,

Samrendra Tibarewalla, CFPCM

Q1: What is a SIP in Equity Mutual Funds, and is it risky?

A Systematic Investment Plan (SIP) in Equity Mutual Funds allows investors to contribute a fixed amount regularly to purchase mutual fund units. According to Nick Murray, the risk of permanent loss in a broadly diversified equity scheme is primarily due to investor behavior, not market volatility. Historical data shows that long-term investments in equity SIPs, particularly over a span of 10 years, have yielded positive returns 100% of the time, with an average annual return of 13-14%.

Q2: Should I invest in Large cap, Mid cap, or Small cap Equity schemes through SIP?

Investment choices depend on your risk tolerance and investment goals. Large cap stocks are generally less volatile, making them a preferred choice for many investors. However, studies indicate that Mid cap stocks have the potential to offer the best returns over the long term, making them an attractive option for long-term SIP investors.

Q3: Is there an optimal date to invest in monthly SIP?

Analysis of the last 26 years of data reveals that the choice of investment date does not significantly impact the average returns of a 10-year SIP. This finding suggests that investors should focus more on maintaining regular investments rather than trying to time the market.

Q4: What is the best frequency for SIP investments?

While some investors believe that a daily SIP might yield the best results due to more frequent rupee cost averaging, this strategy does not necessarily lead to significantly higher returns and can be cumbersome to manage. The data suggests that the frequency of SIP contributions (e.g., monthly, quarterly) does not have a major impact on the overall returns, as long as the total investment amount remains consistent.

The Interim Union Budget for FY2024-25: Key Highlights The Interim Union Budget for FY2024-25 has ca...

samtib@gmail.com